Nike Financial Performance From Time to Time

Nike Financial Performance from Time to Time –

Nike is one of the

biggest companies in the world. Historically, the company that has the slogan “Just Do It” was founded by Bill Knight and Bill Bowerman on January 25th, 1964 with the name

“Blue Ribbon Sports”. In 1971, its name was changed to “Nike”. In the

beginning, they imported the products from Japan because of the cheaper price

than those produced in the USA. Now, Officially, this company has

headquarters in Beaverton, Oregon, Portland, the United States of America with

a total of employees of around 76 thousand people.

Based on the majority shareholders until August 2023, there are 10 Biggest of ownership in Nike. The 10 largest owners of Nike are The Vanguard Group, Inc. with percentage of ownership around (8.39%), BlackRock Fund Advisors (5.13%), SSgA Funds Management, Inc. (4.51%), Wellington Management Co. LLP (2.34%), Geode Capital Management LLC (1.87%), Alliance Bernstein LP (1.83%), Capital Research & Management Co. (1.59%), Fidelity Management & Research Co. (1.24%), Northern Trust Investments, Inc. (1.10%), and Norges Bank Investment Management (0.94%). Culturally, the name of Nike comes from the mythology Goddess in Greece. Nike symbolizes the goddess of victory and success. Maybe this name can give good fortune to the American-based apparel company. Some of their products can lead the market and can beat the competitors for a while.

Most people in the world know Nike, particularly in the sport industries. Nike has long experience and is well-known as a sports apparel company. It produces, markets, and distributes sports apparel. At that time, some famous athletes, clubs, and organizations used their products. Some Nike superstars that have been endorsed by Nike are Cristiano Ronaldo, Neymar, Kylian Mbappé, Roger Federer, Rafael Nadal, Michael Jordan, LeBron James, and other famous athletes from diverse kinds of sports. Meanwhile, in football clubs, Nike makes a partnership with some famous football clubs that have a million fan bases across the globe. Barcelona, Liverpool, Arsenal, and Inter Milan are some famous football clubs that had contracts on their jersey and accessories to Nike. In basketball, Nike had won a contract with the NBA for the production of all NBA jerseys for basketball teams.

Along with the Business Development of Nike from time, Nike had

launched some brands and some subsidiaries, namely Converse and Jordan Brand. Basically, some Nike

products are Nike Golf, Nike Pro, Nike+, Air Jordan, Nike

Blazers, Air Force 1, Nike Dunk, Air Max, Nike Skateboarding,

and Nike CR7. Nike acquired Converse in

2003 at a cost of 300 million US dollars. Meanwhile, Jordan Brand is the

successful partnership between Nike and Michael Jordan. Michael Jordan is a

legendary NBA basketball player with 6-time championships with the

Chicago Bulls. Until now, Jordan Brand is

predominantly focused on basketball sports and has many products on it.

Meanwhile, Converse has some subsidiaries brand i.e. Converse, Chuck Taylor,

All Star, One Star, Star Chevron and Jack Purcell.

The Total Assets, Liabilities, and Equity of Nike

|

|

|||

|

Years |

Total

Assets |

Total

Liabilities |

Equity |

|

|

Billions

of US Dollars |

Billions

of US Dollars |

Billions

of US Dollars |

|

2000 |

5.8 |

2.7 |

3.1 |

|

2001 |

5.8 |

2.4 |

3.4 |

|

2002 |

6.4 |

2.6 |

3.8 |

|

2003 |

6.8 |

2.9 |

3.9 |

|

2004 |

7.9 |

3.2 |

4.7 |

|

2005 |

8.7 |

3.1 |

5.6 |

|

2006 |

9.8 |

3.6 |

6.2 |

|

2007 |

10.6 |

3.6 |

7 |

|

2008 |

12.4 |

4.6 |

7.8 |

|

2009 |

13.2 |

4.6 |

8.6 |

|

2010 |

14.4 |

4.7 |

9.7 |

|

2011 |

14.9 |

5.1 |

9.8 |

|

2012 |

15.4 |

5.1 |

10.3 |

|

2013 |

17.5 |

6.5 |

11 |

|

2014 |

18.5 |

7.7 |

10.8 |

|

2015 |

21.6 |

8.9 |

12.7 |

|

2016 |

21.3 |

9.1 |

12.2 |

|

2017 |

23.2 |

10.8 |

12.4 |

|

2018 |

22.5 |

12.7 |

9.8 |

|

2019 |

23.7 |

14.7 |

9 |

|

2020 |

31.3 |

23.3 |

8 |

|

2021 |

37.7 |

25 |

12.7 |

|

2022 |

40.3 |

25.1 |

15.2 |

|

2023 |

37.5 |

23.5 |

14 |

|

Source:

Nike Annual Report, 2000-2023 |

|||

Financially, from its founding until its operations in 2023, Nike

can perform positive performance. It can be looked at on the Balance Sheets. In 2000,

the assets of Nike were just 5.8 billion US Dollars, and its Equities were 3.1

billion US Dollars. Meanwhile, in 2023, the assets will become 37.5 billion US Dollars and equities will become 14 billion US Dollars. It means that assets can grow

more than 6 times from 2000 to 2023.

The Revenue and Net Income of Nike

|

|

||

|

Years |

Revenue |

Net

Income |

|

|

Billions

of US Dollar |

Billions

of US Dollar |

|

2000 |

8.9 |

0.57 |

|

2001 |

9.4 |

0.58 |

|

2002 |

9.8 |

0.66 |

|

2003 |

10.6 |

0.74 |

|

2004 |

12.2 |

0.94 |

|

2005 |

13.7 |

1.2 |

|

2006 |

14.9 |

1.3 |

|

2007 |

16.3 |

1.4 |

|

2008 |

18.6 |

1.8 |

|

2009 |

19.1 |

1.4 |

|

2010 |

19 |

1.9 |

|

2011 |

20.8 |

2.1 |

|

2012 |

23.3 |

2.2 |

|

2013 |

25.3 |

2.4 |

|

2014 |

27.7 |

2.6 |

|

2015 |

30.6 |

3.2 |

|

2016 |

32.3 |

3.7 |

|

2017 |

34.3 |

4.2 |

|

2018 |

36.3 |

1.9 |

|

2019 |

39.1 |

4 |

|

2020 |

37.4 |

2.5 |

|

2021 |

44.5 |

5.7 |

|

2022 |

46.7 |

6 |

|

2023 |

51.2 |

5 |

|

Source:

Nike Annual Report, 2000-2023 |

||

Based on the business performance from time to time from 2000 to

2023, the revenue and net income also showed a positive impact. The revenue of

Nike in 2000 was just 8.9 billion US Dollars, with Net Income reaching 570

million US Dollars. In 2023, the revenue of Nike

becomes be 51.5 billion US Dollars, and the net income reaches 5

billion US Dollars. Overall, the revenue can grow more than 4 times and Income

can grow more than 9 times from 2000 to 2023.

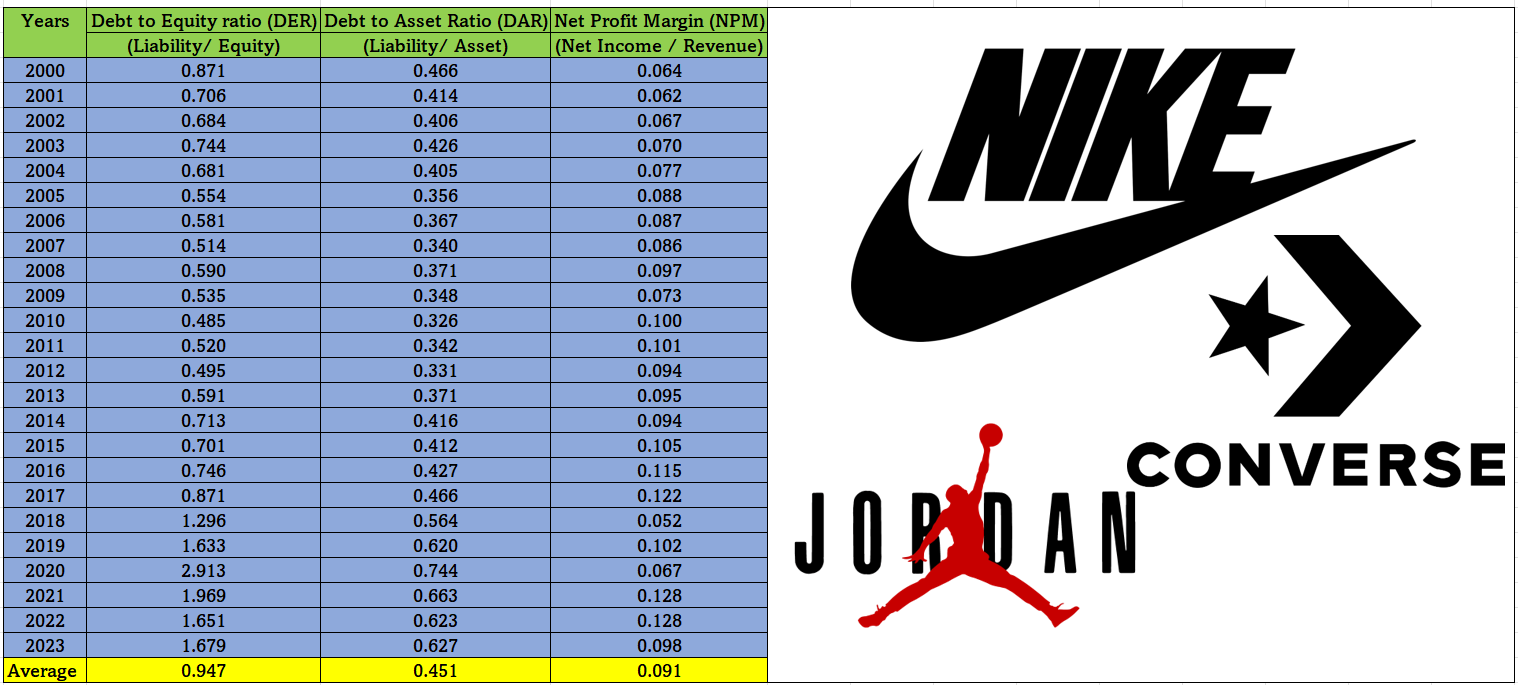

Financially, some financial ratios can be measured from the balance sheets and income statements. In this case, we measure Debt to equity ratio (DER), Debt to asset ratio (DAR), and Net profit margin (NPM). Financially, the average value of Nike’s Debt equity ratio (DER) from 2001 to 2023 is about 0.94. Basically, it means that the percentage of liabilities is about 94 % of the equities or it shows that every one dollar of equity contains 0.9 dollars of liabilities.

Meanwhile, the average value of Nike’s Debt to asset ratio (DAR)

is about 0.45. This value means that the percentage of liabilities is about 40%

of the assets, or it can be described that every one dollar of asset contains

0.45 US dollars of liabilities. Overall, the value of DER and DAR can describe

the financial structure of the company. The smaller

the value of DER and DAR, the better and healthier

the company.

In the other variable from the income statement from 2001 to 2023,

the average value of the Net profit margin (NPM) is about 0.091. Basically,

this value means that the percentage of net income is about 8.8% percent of the

revenue. In another interpretation, it can mean that every 1 US Dollar of

revenue can become 0.09 US dollars of net income. Basically, Net profit margin

(NPM) can describe the efficiency of their business. The greater value of NPM

can show the more efficiency of the company in doing their business.

Bibliography of Nike Financial from Time to Time

Nike. 2024. Annual

Report. Accessed

via https://investors.nike.com/investors/news-events-and-reports/default.aspx

on April 2nd, 2024.

Wikipedia. 2023. Nike. Accessed via https://en.wikipedia.org/wiki/Nike,_Inc on April 2nd, 2023